What’s the word for when a small-college president pays $422,500 of the college’s money—the second-highest amount paid to any vendor for the year—to his own consulting firm, a sole proprietorship?

Clip from 2017 interview with Bill Kristol featuring additional context.

Research from this story and the embedded document below led to coverage by Inside Higher Ed. Click the image to view the coverage. Embedded document below fills in additional details.

Midland Lutheran College hired one-time management consultant Ben Sasse as its president in October of 2009, with expectations that the then-assistant professor at UT Austin could “turn around” the school’s finances.

By the end of Mr. Sasse’s first full semester with the school, with an enrollment of 590 students, Midland had paid $422,500 to “Platte Strategy Consulting”.

Page 9 of Midland’s 2009/2010 tax Form 990 “Section B. Independent Contractors.” View full form using ProPublica’s Nonprofit Explorer database.

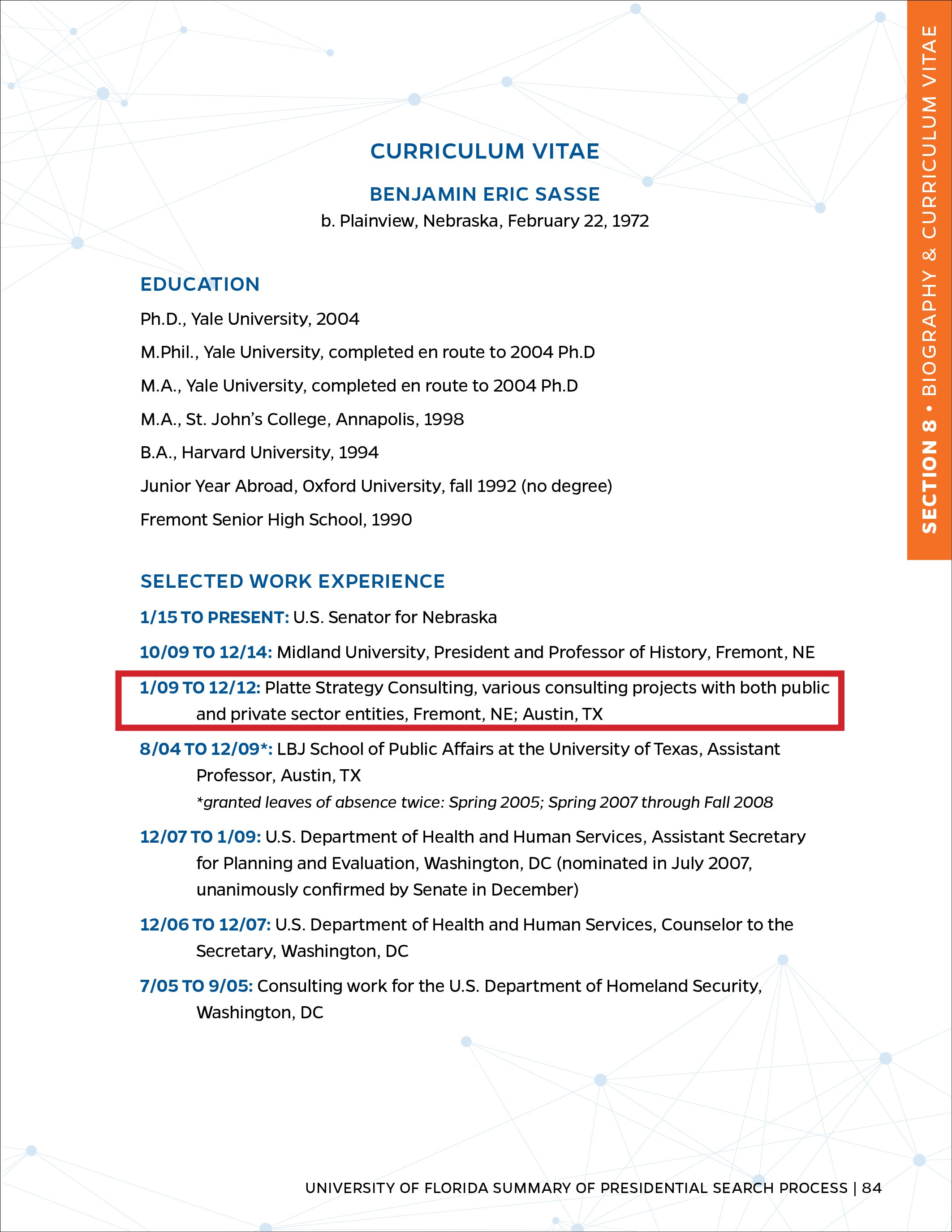

According to a curriculum vitae submitted to the University of Florida by Mr. Sasse, he worked at “Platte Strategy Consulting” from November of 1995 to December of 2002, and again from January of 2009 to December of 2012.

The first 2 pages of Mr. Sasse’s curriculum vitae, submitted to the University of Florida and distributed in the “Summary of Presidential Search Process” document.

A Google search for “Platte Strategy Consulting” returns one result—a profile on a directory for vendors seeking government-funded projects in Virginia. The listing names Sasse as sole proprietor.

The “Platte Strategy Consulting” profile listing on Virginia Bids (link since removed).

Midland announced Sasse as president elect of the school in mid-November of 2009 with a start date scheduled for the following April. This timeline was established to allow Sasse to conduct a thorough evaluation of the college before taking on the role of president. Sasse asserted that he would be starting right away, and began executing major staff and budget cuts while initiating major new programs.

Midland tax forms from this time characterize Sasse as an unpaid “Officer” rather than employee, though working 40 hours, weekly.

Over the same 5-month period, Platte Strategy Consulting is paid $422,500 for “consulting”—approximately 250% of what Sasse would earn in his first year paid as an employee of the college rather than through his private firm.

Midland’s tax documents affirm the school was not party to any transaction with any “Officer” of the school; then pages later name Ben Sasse as an “Officer”.

Sasse would eventually take office on March 29 of 2010. From mid-November of 2009 through April of 2010, Sasse was president of Midland while not an employee.

Page 19 of Midland’s 2009/2010 tax Form 990 affirms that Ben Sasse was an “Officer, Director, Trustee, Key Employee, Highest Compensated Employee, or Independent Contractor” of Midland University.

Page 5 (28a) of Midland’s 2009/2010 tax Form 990 affirms that Midland was not “party to a business transaction with…a current or former officer, director, trustee or key employee.”

What’s it called when a college pays its president’s private consulting firm $422,500—the second-highest amount paid to any vendor for the year—then fails to disclose the nature of the transaction and relationship on its taxes?

What are the potential offenses and consequences?

Click links below for additional documentation and context.

If publishing all or part(s) of this article, as quoted or paraphrased, please apply the following standards of attribution (to Announce).