What’s the word for when a small-college president pays $422,500 of the college’s money—the second-highest amount paid to any vendor for the year—to his own consulting firm, a sole proprietorship?

Clip from 2017 interview with Bill Kristol featuring additional context.

Midland Lutheran College hired one-time management consultant Ben Sasse as its president in October of 2009, with expectations that the then-assistant professor at UT Austin could “turn around” the school’s finances.

By the end of Mr. Sasse’s first full semester with the school, with an enrollment of 590 students, Midland had paid $422,500 to “Platte Strategy Consulting”.

Page 9 of Midland’s 2009/2010 tax Form 990 “Section B. Independent Contractors.” View full form using ProPublica’s Nonprofit Explorer database.

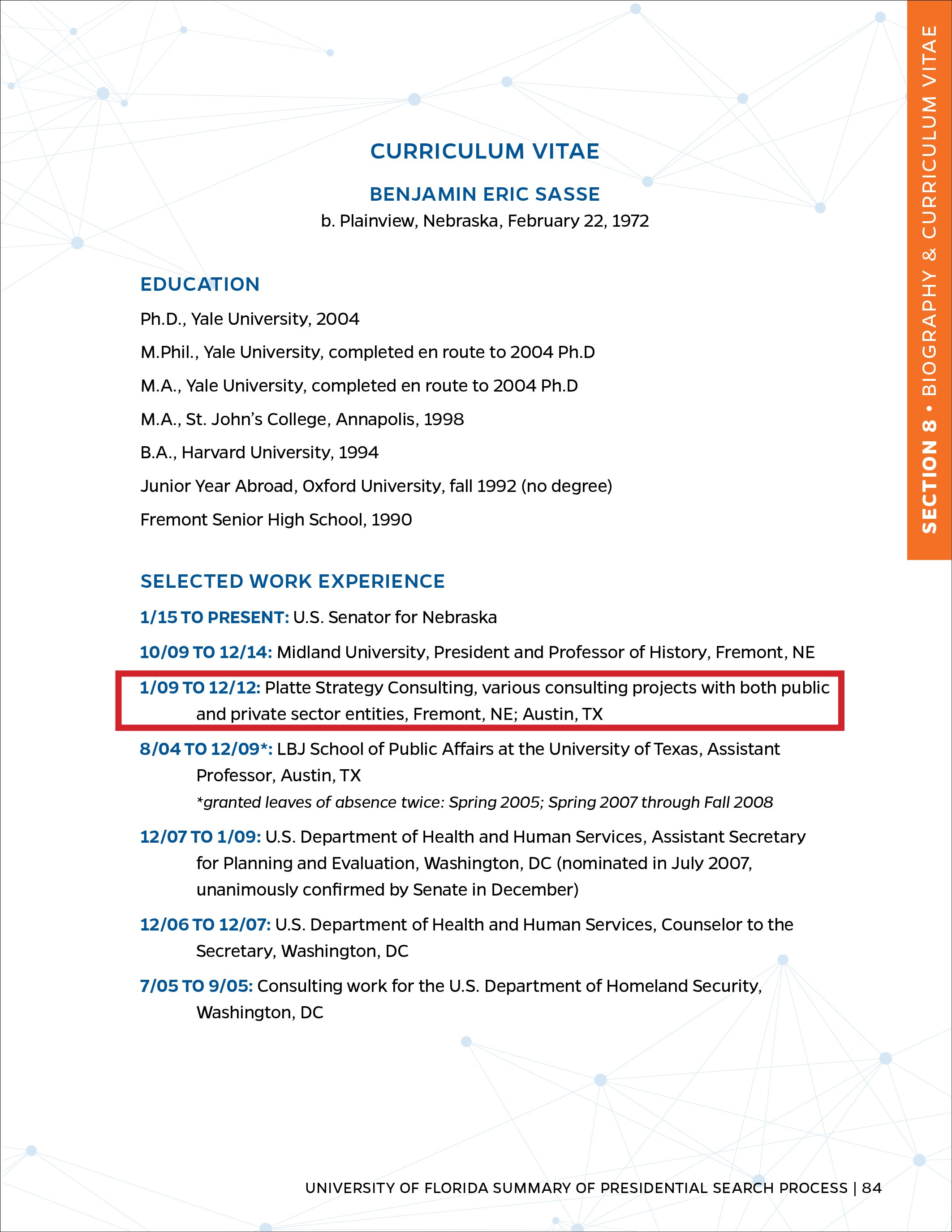

According to a curriculum vitae submitted to the University of Florida by Mr. Sasse, he worked at “Platte Strategy Consulting” from November of 1995 to December of 2002, and again from January of 2009 to December of 2012.

The first 2 pages of Mr. Sasse’s curriculum vitae, submitted to the University of Florida and distributed in the “Summary of Presidential Search Process” document.

A Google search for “Platte Strategy Consulting” returns one result—a profile on a directory for vendors seeking government-funded projects in Virginia. The listing names Sasse as sole proprietor.